How universities are coping as international students retreat

Universities are reconsidering their campus experience to address a revenue gap left by dwindling enrolments

Nearly a decade ago Australia’s universities opened their doors wide to foreign students eager to study in an English-speaking country that regularly ranks highly for its quality of life.

The response was ecstatic. Last year, higher education was the country’s third largest export.

But lockdowns and travel restrictions have largely expelled the study-abroad concept, at least for now. The slump in international students is set to leave a A$16 billion (US$11.4b) hole in university finances over the next three years, according to Universities Australia.

Pandemic-induced declines in international students is affecting universities the world over. In the U.S., the American Council on Education predicts international student enrolments will have declined 25 percent this fall. The Institute of International Education calculates a US$4.5b revenue gap.

But in Australia the pain is particularly acute, leaving universities scrambling for ways to claw back billions of dollars in lost revenue.

“Class closures, dips in enrolment numbers and cancellations might be temporary, but the disruption is already far-reaching,” says David Brown, Head of Strategic Consulting – Victoria, JLL. “Australia has had a decade-long boom in international education that has been snatched away overnight, leaving universities excessively exposed.”

Ideas into action

Campus real estate, one of the biggest expenses for universities, is increasingly seen as a major source of untapped capital, with universities repurposing, selling and leasing back buildings, and forming partnerships with other businesses.

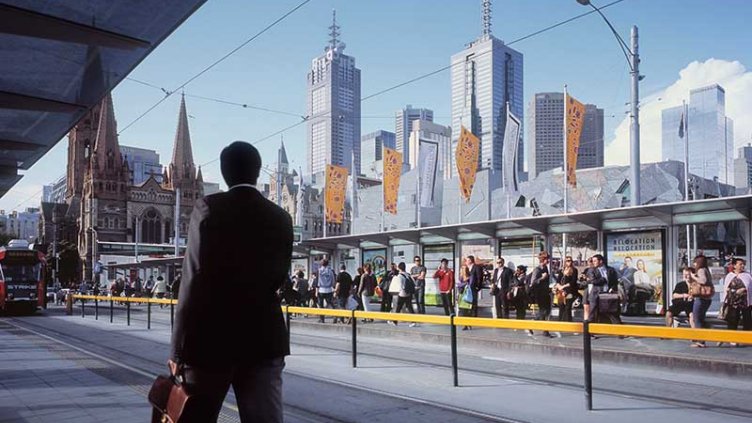

“The crisis is reinforcing long-held visions of transforming staid old education campuses into vibrant mixed-use urban centres,” says Brown. “The goal is attracting students, enhancing learning, and monetising otherwise inefficient real estate.”

In Melbourne, Australia, La Trobe University is proceeding with the largest redevelopment in its 56-year history – the A$5 billion City of the Future project at its 235-hectare Bundoora campus. The project will provide a new town centre, health and wellbeing hub, childcare and clinical facilities, education facilities for 40,000 students, housing, a sports park, research and innovation buildings, and community parks.

The project was conceived in 2014, but the pandemic has raised the stakes financially. Divestment opportunities and creating annual revenue from its land, such as through ground leases, joint ventures where land ownership is retained and profits shared with developers, or developing new buildings and renting them out, are ideas receiving additional emphasis.

“A ground lease can potentially generate long-term rental income and tax revenues by leasing land to a developer to build an office, incubator, hotel or multifamily housing, and having the developer pay not only for the design and construction, but also financing, operating and maintenance costs, including property taxes,” Brown says.

RMIT University, also in Melbourne, is unlocking A$130m through the sale of its Bourke Street tower with a leaseback, while Swinburne University is offloading a building in Flinders Lane.

In the U.K., university leaders are understood to be weighing up the need to extract capital from their buildings with the requirement for additional space to accommodate distancing. New accounting regulations are likely to make partnerships with developers favourable over sale-and-leasebacks.

Developers, which have long been sought by universities to undertake major works on campus as part of shared-profits arrangements, are unlikely to be swayed by the economic crisis.

“The sentiment is that there is going to be an end to this,” says Matt Do, senior vice president of JLL’s public institutions group in the U.S. “Investors are financing today, but the assets aren’t going to be built and operated for a couple of years, and so they feel comfortable that by then that demand will return to strength.”

Other avenues for fresh cash

As well as asset sell-offs, stricken universities are looking to plug funding shortfalls with operational efficiencies, such as outsourcing facilities management, or shifting from faculty-owned to centrally-managed space.

The longer-term legacy of real estate rationalisation will be institutions that are more integrally linked with industry, Brown says.

“This is the time for universities to show they are in step with a labour market that is becoming far more dynamic than it ever was,” Brown says. “And once students are confident about returning to campus life, this, along with the ability to learn in a vibrant, buzzing urban destination, will be major factors in their decision-making.”