How 5G is set to spur new data center construction

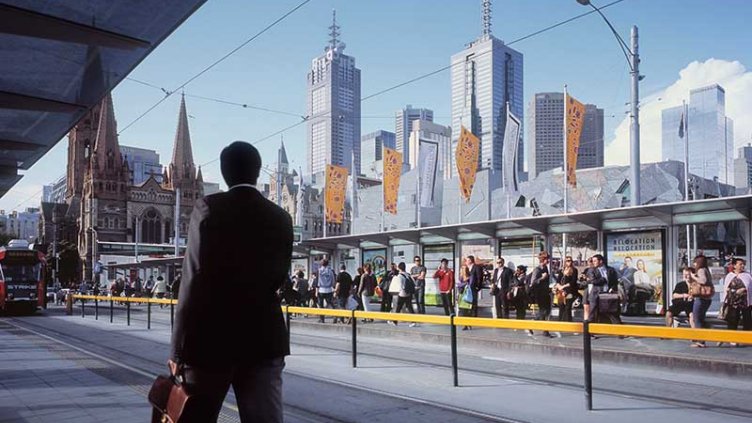

The arrival of 5G requires commercial property to be constructed in dense urban areas close to the customer.

Wireless networks are gearing up for 5G, an upgrade that will make the internet experience exponentially faster, eventually touching all industries and sectors.

Experts have warned not to expect visible changes too soon, with countries and telecom companies implementing the technology gradually. But one thing is already for certain: data storage will have to keep pace.

“Demand for modern data centers last year was the strongest we’ve ever seen,” says David Barnett, manager of Americas Research at JLL. “Developers realize that real estate will be the backbone of 5G. And they want in.”

Last year, for example, CIM Group and 1547 Critical Systems Realty broke ground on a 240,000-square-foot data center campus in San Francisco – the city’s first data center in over 10 years.

Virtually all the major mobile carriers in the U.S., including T-Mobile, Sprint, AT&T, Verizon and – most recently – U.S. Cellular, have said they’ll begin offering 5G this year. They’ll follow on from Seoul, which in April became the first city in the world to offer 5G.

Data center development

With claimed speeds of 20-times faster than 4G – giving users quicker downloads and network operators greater efficiencies – the technologies involved will open doors for industries, changing how they think and what they do with mobile connectivity.

This demand will spur development of data centers, which house, protect and distribute the key parts of internet technology, operations and hardware. But they won’t be built just anywhere.

In the past, data centers were often large buildings in the outskirts of major cities. But the arrival of 5G requires them to be constructed in dense urban areas in order to improve latency, the delay before the data transfer.

It’s much like how the demands of e-commerce and same-day delivery have resulted in the development of smaller warehouses in major cities that enable a product’s final push to the consumer, says Barnett.

“The industry is expecting to see an increase in the number of data center locations, but smaller footprints,” he says. “This is because infrastructure, such as cooling systems, becomes more efficient and much more powerful each year, requiring less physical space.”

Global demand

There are currently 63.4 million square feet of data-center space globally, and another 4.3 million square feet under construction, according to JLL. But the pipeline is primed to balloon.

For instance, Digital Realty, a co-location company that develops and leases data centers, bought 450 acres of land in Northern Virginia late last year and plans to deliver 8 million square feet.

Northern Virginia has always been a draw for organisations working with the federal government, which spends billions every year on private contractors and has slowly been uploading its data into the cloud, Barnett explains.

“But now there’s a whole new level of demand for data storage,” he says. “This year the Pentagon plans to spend $2 billion on cloud computing, more than they’ve ever spent.”

And even after building a record amount of data center space last year, a lot more is currently in the pipeline for London, Phoenix, Singapore, Northern California, Sydney and Hong Kong, according to JLL research.

The large supply of new data center space coming to market is something owners and developers should keep an eye on, says Barnett.

“So far, demand is very strong,” he says. “And it’ll stay that way as long as we keep storing more information in the cloud and keep consuming more content.”